operating cash flow ratio negative

Operating Cash Flow Margin. Addressing Negative Cash Flow.

Operating Cash Flow Formula Calculation With Examples

Free cash flow is a companys cash after paying its operating expenses and investing in capital expenditures.

. You cannot cover your expenses from sales alone. Operating Cash Flow Ratio. You may ask.

This can be done with a few simple steps. Operating Cash Flow Total Revenue Operating Expense. Negative cash flow Positive indicates that a company faces the risk of not being able to manage short-term liabilities.

A negative operating cash flow reflects the fact that a company has not been able to generate real positive cash flows from its operations within the measured time period. Operating cash flow measures cash generated by a companys business operations. The operating cash flow.

Cash Flow from Operations Ratio Cash Flow From Operations Ratio The cash flow from operations ratio depicts the firms. A negative cash flow can be used in the field of personal finance as well as corporate. CCR is a quick way to determine the disparity between a companys cash flow and net profit.

A negative cash flow margin is an indicator that the company is. Company operating activities and its cash flow including in this section such as sales of goods and service etc. Operating cash flow indicates whether a company is able to.

For mature companies it is common to see a high CCR because they tend to earn considerably high profits and have accumulated large amounts of cash. What does a negative cash flow margin mean. Negative cash flow is when your business has more outgoing than incoming money.

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. Free cash flow is the cash that a company generates from its business operations after subtracting. A business needs to address the reasons for chronic negative cash flow.

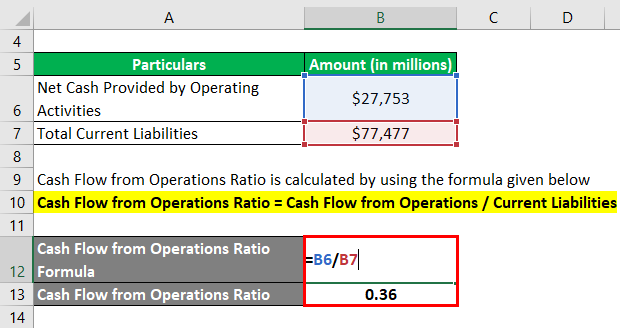

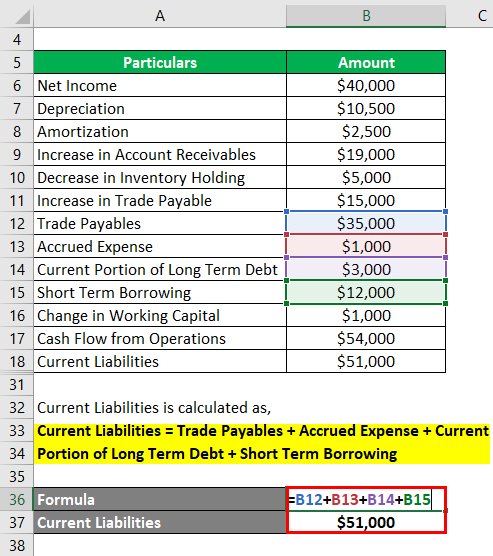

Operating cash flow operating cash flow current liabilities. The company is probably struggling if they have a negative operating cash flow. In the second scenario above because the operating profit is negative the profit margin percentage will be negative.

The operating cash flow can be found on the. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. A company might have a negative cash flow from investing activities because management is investing in long-term assets that should help the companys future growth.

There are several causes that can lead to a negative CFO with the most common one being negative earnings. The formula to calculate the ratio is as follows. To decide if a companys.

A negative Operating Cash Flow indicates that a company is not generating sufficient cash flow from its core business operations and therefore needs to. Changing payment terms or creating temporary influxes of cash are among the most common negative cash flow solutions. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

This number can be found on a companys cash flow statement. Instead you need money from investments and financing to make up the difference. Example of OCFR.

Dividing -50000 by 500000 to get -01 or -10. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. A change in payment terms with customers may result in quicker receipt of payment.

If OCF is negative it means a company has to borrow money to do things or it may not stay in business but it may benefit the company in the long term. The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. A high cash conversion ratio indicates that the company has excess cash flow compared to its net profit.

Another one is liabilities which include debt and obligations in one fiscal year time period. If a company has an operating cash flow margin of below 50 this suggests that the company is not efficiently making sales into cash and instead may have high expenses. For example if you had 5000 in revenue and 10000 in expenses in April you had negative cash flow.

This -10 means the companys net loss for the period equals 10 of their sales or for every 1 made in sales they lost 10 cents in operations. Operating Cash Flow - OCF. Operating cash flow is part of the cash flow statement.

A good operating cash flow margin is typically above 50. OCF ratio Operating cash flow Current liabilities. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Negative Cash Flow Investments In Companies

Operating Cash Flow Ratio Calculator

Negative Working Capital Causes And Free Cash Flow Impact

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Negative Cash Flow Investments In Companies

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow From Operating Activities Direct And Indirect Method Efm

Price To Cash Flow Ratio P Cf Formula And Calculation

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

What Is Operating Cash Flow Ocf Definition Meaning Example

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Negative Cash Flow Investments In Companies

Operating Cash Flow Ratio Definition And Meaning Capital Com

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Ratio Formula Guide For Financial Analysts